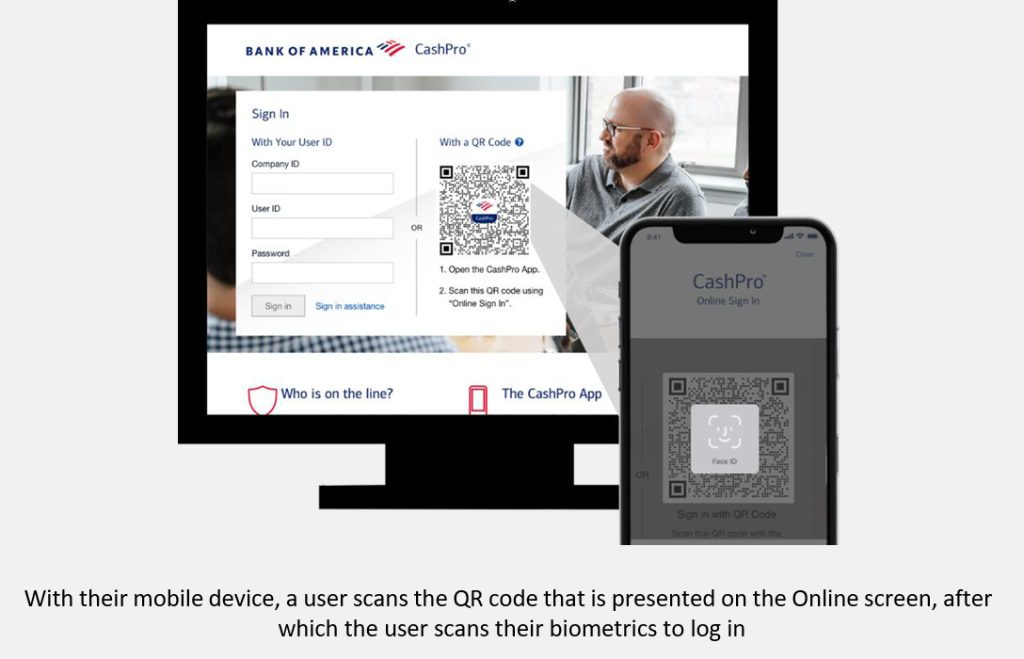

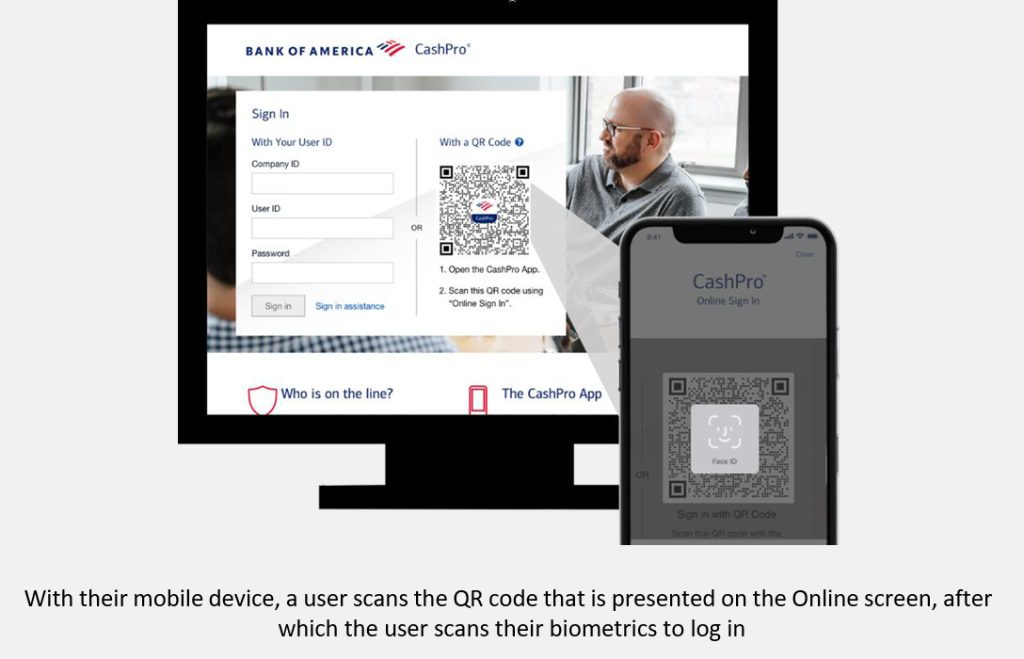

NEW YORK CITY, NY – Bank of America today announced the launch of QR sign-in for CashPro, a development that makes it easier for companies to access their payments, cash management and trade finance operations. The bank’s 500,000 CashPro users now have the option to sign into the website using their mobile device by scanning a QR code and their biometrics via the CashPro App, replacing the need to manually enter password credentials.

“QR sign-in is a technology that’s familiar to our clients from their personal lives, and now they can use it to seamlessly access CashPro,” said Tom Durkin, global product head for CashPro Platform in Global Transaction Services (GTS). “The technology kicks off a schedule of enhancements we plan to introduce to CashPro over the next 18 months that will further improve the simplicity and security of our award-winning platform.”

Mobile authentication is a natural extension of the ubiquitous worldwide adoption of mobile devices and the increasing comfort clients have in using them for business purposes. QR sign-in is powered by patented technology that allows a mobile device to be used as a method for computer authentication. It is the first of a series of enhancements for CashPro aimed at reducing the reliance on traditional forms of user credentials and making the user experience simpler and more secure.

Bank of America listens carefully to its client users through the CashPro Client Advisory Boards that represent companies of varying size and complexity as the bank designs and implements new security and innovation features. “The CashPro Advisory Boards generate invaluable dialogue that help ensure the enhancements we make to the platform fuel our clients’ own growth objectives,” said Ken Ullmann, co-head of GTS for Global Commercial Banking at Bank of America. “QR sign-in is the latest example of the collaboration achieved through the Advisory Boards.”

Bank of America has been named the World’s Best Bank for Payments and Treasury by Euromoney magazine for the past two years. Additionally, CashPro and the CashPro App consistently receive third party recognition such as:

- Celent Model Bank 2022 Award for Corporate Digital Banking, Celent

- Best Mobile Cash Management Software, Best Treasury and Cash Management Providers 2022: Systems and Services, Global Finance magazine

- Best Mobile Technology Solution, Technology & Innovation Awards 2021, Treasury Management International (TMI)

- CashPro Forecasting named Best Cash Management Project for 2022, The Asian Banker

Bank of America

Bank of America is one of the world’s leading financial institutions, serving individual consumers, small and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. The company provides unmatched convenience in the United States, serving approximately 67 million consumer and small business clients with approximately 4,000 retail financial centers, approximately 16,000 ATMs and award-winning digital banking with approximately 55 million verified digital users. Bank of America is a global leader in wealth management, corporate and investment banking and trading across a broad range of asset classes, serving corporations, governments, institutions and individuals around the world. Bank of America offers industry-leading support to approximately 3 million small business households through a suite of innovative, easy-to-use online products and services. The company serves clients through operations across the United States, its territories and approximately 35 countries. Bank of America Corporation stock (NYSE: BAC) is listed on the New York Stock Exchange.

“Bank of America” is the marketing name used by certain Global Banking and Global Markets businesses of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of

America Corporation, including Bank of America, N.A., Member FDIC. © 2022 Bank of America Corporation. All rights reserved.

For more Bank of America news, including dividend announcements and other important information, visit the Bank of America newsroom and register for news email alerts.

Reporters May Contact:

Louise Hennessy, Bank of America Phone: 1.646.858.6471