Payments innovation is no longer driven by huge banks with coast-to-coast branch networks but by smaller, entrepreneurial providers with the vision and passion to democratize payments and embed them into business operations.

But how do these startups, innovators, and smaller providers get into the game in a way and at a cost that’s accessible? To answer that question and learn more about how the new Galileo Instant Solution helps businesses support gig workers, PaymentsJournal sat down with Cole Wilkes, Managing Director, Galileo Instant at Galileo Financial Technologies and Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group.

The U.S. gig economy

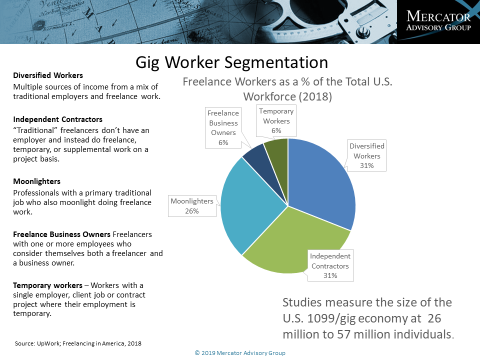

While there’s no universal definition of what qualifies as gig work, there have been studies that have attempted to measure the size of the 1099/gig economy workforce in the United States. Even studies using the most restrictive definition of what qualifies as gig work estimate the gig workforce to be at least 26 million people strong. High estimates have measured the gig workforce to hover around 57 million individuals.

The wide range of estimates, explained Grotta, is due to “a variation in what really constitutes a gig worker.” There are also different segments of the gig industry. Some individuals use gig work to supplement their traditional jobs, while others do occasional freelancing on the side; some consider themselves business owners, and others are working for a single employer as a contracted worker. Regardless of the exact number, Grotta added, “This is a really big market—and one that requires unique payment solutions.”

The gig economy gap

Gig economy workers have traditionally relied on legacy payment methods, such as paper checks and ACH payments, to receive compensation. But these forms of payment are plagued with latency, infrequency, and inaccessible funds.

In other words, legacy payment methods are not meeting gig workers’ needs, particularly when gig workers are stuck waiting for their next paycheck. “In some cases, [their payment] is as infrequent as once a quarter,” noted Wilkes. “With the dependence on physical checks, there is a lot of room for improvement.”

As a result, non-fintech businesses are now expressing interest in creating their own cards and accounts for customers and workers to alleviate a pain point for gig workers by enabling them to get paid and transact in new and innovative ways.

Galileo Instant

Considering the needs of gig workers—such as Uber drivers, contract workers, YouTubers, and Instagram influencers, among others—Galileo set out to offer a solution that aligns with the payment needs of today’s gig workers. That’s why it developed its new solution, Galileo Instant, with the goal of removing friction for fintech innovators and those looking to issue payment cards without being in the payments business.

“With Instant, Galileo created a way to enable businesses to provide their own card account and pay these individuals in real time—on a per gig or per stream basis—giving them access to their funds as the income is generated,” added Wilkes.

Instant is an end-to-end API platform that makes it easy for non-fintechs and startups to create digital banking and branded card experiences. And it’s a game-changing solution for businesses that don’t necessarily see payments as central to their core offerings, but recognize the value of offering a convenient, branded card solution.

The differentiator is its speed

A key component of Instant is speed of implementation. Typically, it can take months for a business to put digital banking and branded card capabilities in place, but with Instant, deployment can be reduced to as few as 14 days. “To have an out-of-the-box solution enabled within such a short timeframe provides a way for businesses looking to get to market or create their financial products quickly,” explained Wilkes.

Instant was built directly on Galileo’s proven payments platform and utilizes features of its powerful APIs, ensuring that scalability, security, and stability are inherent in the platform. This means that if an organization quickly gets to market and sees high adoption rates, Instant can easily accommodate and scale in parallel with that business.

Conclusion

Consumers are demanding more flexible ways of being paid and businesses need to recognize and adapt to this demand or they could find their workforce leave for an organization that meets their needs. At the same time organizations need to make sure that the process they enable is going to be reliable, fast, and can scale as the organization’s needs change.

In response to this market need, Galileo launched Instant to enable fintechs, startups, and other innovative businesses to create branded payment cards and offer digital banking experiences to customers and employees. In addition to streamlining the card creation process, the Instant API is revolutionary for its ability to support businesses launching card programs in as few as 14 days, start to finish.