Business and larger-market credit card products are valuable assets for the clients of financial institutions, banks, and credit unions. However, not every FI has such an offering. In fact, many financial service providers need a better understanding of the difference between business cards and larger-market credit card products, such as corporate cards, purchasing cards (P-Cards), multi-cards, and virtual cards.

Further, even for Issuers with some knowledge about these larger-market products, many need clarity on which products are most appropriate for their business clients. And they are seeking consultative advice on the business hurdles and expertise required to achieve commercial card program profitability.

To dig deeper into these needs and offer insight into how banks, financial institutions, and credit unions can successfully deploy commercial card offerings, PaymentsJournal sat down with Kris Carrera, Business Line Executive, Credit Solutions at FIS, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

An overview of the commercial credit card space

According to Murphy, there are seven major product sets in the broader commercial card space. Five are associated with credit, and two—debit and prepaid cards—are not. The five credit-related commercial card types include:

- Corporate cards, which have traditionally been used for travel and expense (T&E) management. However, some of that spend shifted to maintaining home offices and other creative use cases during the pandemic.

- Purchasing cards (P-Cards), which are used for maintenance repair operations (MRO) expenses. Larger ticket items and payables have also begun to migrate to P-Cards.

- Multi-cards, which are used by companies that want to keep all their expenses within a single program.

- Fleet cards, which are specialty fuel cards used for vehicle and fuel maintenance and repair in commercial fleets.

- Small business cards, which are designed to support both the basic T&E expenses and office expenses associated with running a small business.

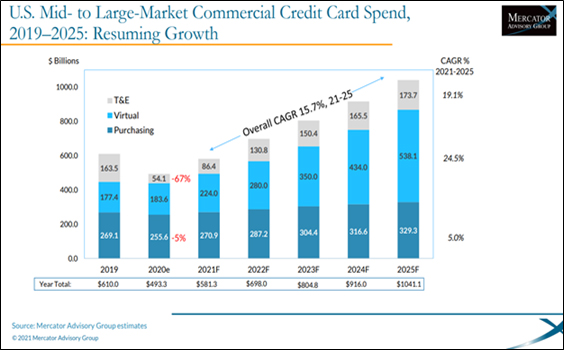

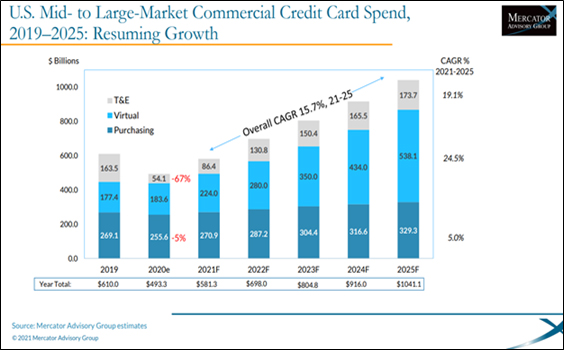

“If you add all of these together, you’ll get in the range of $2 trillion in spend annually in the U.S.,” explained Murphy. Among these card types, P-Cards and multi-cards are seeing the most rapid growth.

What’s noteworthy is that both are often delivered in the form of virtual cards. Financial institutions can leverage the benefits of virtual cards to differentiate their commercial card offerings. “These are single use types of non-plastic cards—that’s the fastest growing segment in the commercial credit card space at about 20% per year… and that’s really the only sort of delivery method during the pandemic that did not decelerate in growth. It’s back to pretty large growth in 2021,” he added.

Deploying the right commercial card program

Financial institutions ranging from community credit unions to large banks are using commercial card programs. As community banks attract more small business deposits, they are looking at new products to satisfy customer demand. Meanwhile, larger banks are likely to have a large commercial and treasury base but may not yet offer a commercial card program.

“The give and take [is] that we have treasury managers out there wanting to sell an additional product to their very valuable customer base, as well as these customers that are new to the bank who are demanding products like a revolving [credit] facility… so they can continue to do that business,” said Carrera.

Given the breadth of commercial card types available, it can be difficult for financial institutions to identify the best products to offer their business clients. Having a deep understanding of their customer base is key to solving this problem. “[FIS] is consulting with these financial institutions on what the segmentation of their customer base is. Especially on the customer side, that’s where we get into more about the specific product. Does it really fit the spending needs of these verticals?” asked Carrera.

For example, the medical industry is particularly savvy when it comes to knowing the products, rebates, and data they are looking for. Other sectors, such as the auto industry, have different needs. More specifically, FIS has seen several auto dealerships in the Midwest express interest in buying goods and services on P-Cards because it allows them to track spend and see a higher level of transaction details.

Higher education is another example of an industry with unique needs. “Schools and universities were probably one of the first adopters [to] truly [understand] the value of a purchase card and a T&E card, especially for traveling teachers,” explained Carrera. Commercial card programs are significantly more likely to succeed if banks and credit unions cater these programs to the needs of their business clients.

A little underwriting goes a long way

Another important part of deploying a commercial card program is understanding the back-office operations, spend potential, and risk that go into it. Murphy highlighted how commercial card programs can go awry, using the example of a hypothetical small business with $10 million in annual revenue. If the business spends 90% of its revenue in direct and indirect costs, it accrues $9 million in expenses each year.

Commercial credit cards are currently used in about 3% of payables across all business sizes. Using that number as a reference point, a $10 million business may spend around $270,000 on a commercial card program each year.

Another way to estimate card spend is by acknowledging that commercial cards are typically not used for direct spend. Assuming direct and indirect spend are equal, that same business would have indirect expenses of around $4.5 million per year. Estimating that 10% of this spend goes to T&E and MRO, the business may spend up to $450,000 on a commercial card program each year.

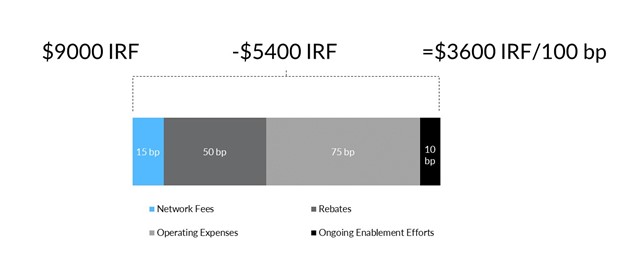

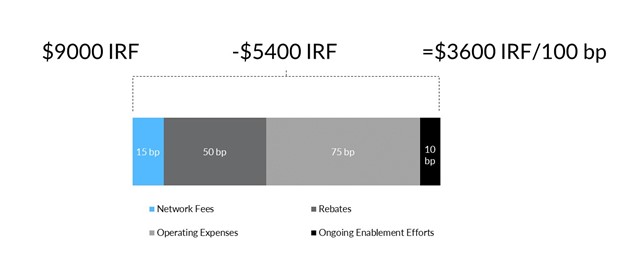

Averaging the two estimates above for a more accurate prediction, Murphy estimates around $360,000 in commercial card program spend for a $10 million business. While the issuing bank would profit from around $9,000 in interchange fees, the cost of rebates, net operating expenses, and enablement expenses may very well leave them in the red.

While the estimate is just that—an estimate—it’s also “a way to think about whether a full-scale commercial card program is the right one for a relatively small business. You have to figure out whether or not those businesses need all the technical capabilities that a full-scale commercial card program can provide: the spend management integration, the card management program, the hierarchy, the central billing capabilities, and so forth,” said Murphy.

The takeaway

The most successful commercial card issuers are those that put thought and effort into their programs. Understanding the upfront costs and risks of launching a commercial card program and being able to scale it up and expand in the future are key.

“What an FI should be doing is a thorough analysis of their business client portfolio. They must figure out how many clients they have by revenue size [and] by industry vertical, then figure out average travel budgets. How much did they spend on payables every year? What is the business growth potential? Then use all that information to determine if a commercial card program is worthwhile launching and [if it] will be a profitable business,” said Murphy.

Collaborating with a trusted partner can help banks decide the best approach to a commercial card program. FIS offers a robust selection of small business and commercial card products that meet the needs of financial institutions’ business customers.

“From a scale perspective, investing in commercial capabilities, expense management, and card management [are important]. From there, once you get that up and running, it is the value of adding additional companies and seeking more companies and cross-selling into the business Demand Deposit Account (DDA) or customer base to make them aware that there is a card product out there,” concluded Carrera.

Interested in speaking to the FIS PaymentsEdge Marketing and Advisory Team directly about growing your small business or commercial card programs? Email us at: [email protected]