Venmo is a digital person-to-person (P2P) payment platform that allows users to send and receive money between friends, family, and businesses. It has become so popular that “Venmo” is now a commonly used verb. Venmo, which is owned by PayPal, has 62.8 million active U.S. users in 2023, and is projected to grow by 8.8% in 2024, rising to 68.3 million active users. Millennials, who enjoy making digital P2P payments, are the main driver fueling this growth.

As society continues to utilize digital transactions over physical cash, many consumers may be taking digital payment benefits, such as chargeback guarantees, for granted. Moreover, do we understand that not all digital payments are the same?

Chargeback guarantee provides consumers with protection to get their money back for fraudulent charges or purchases that do not live up to standards. Consumers can submit disputes with their financial institutions to help recover their funds. Most issuers offer chargeback guarantee protection on credit and debit cards.

But with Venmo, users are not always paying with their credit or debit card. Users can also link their bank account, from which money is debited directly. When users transact via Venmo, they can use their Venmo account balance to pay another user.

Last week, I forgot I had money in my Venmo balance after a friend had paid me. It’s the same sense of joy you feel when you unexpectedly find a $20 bill in a coat pocket! I had to pay a professional makeup artist for a makeup trial and was thrilled to find the available Venmo balance. I didn’t have to add funds from my bank account, which was a nice sense of relief.

Since it was my first time paying this user, I assumed Venmo would require the additional layer of security—entering the last four digits of her phone number. But to my surprise, Venmo did not require the additional information and the payment went through. At that point, I realized I had paid the wrong person! The username was off by one letter.

The funds were immediately deducted from my Venmo wallet. I panicked and did not know what would happen. These funds weren’t paid by my financial institution. I didn’t have a chargeback guarantee. (I’ve previously written about the lack of a fraud guarantee on P2P payment apps: Banks Take a Proactive Stand to Resolve Zelle Issues.)

Venmo has taken action to improve customer protection and set up its own internal system to reverse transactions sent in error. After jumping through many hoops to find their contact form, I was able to submit a “dispute.”

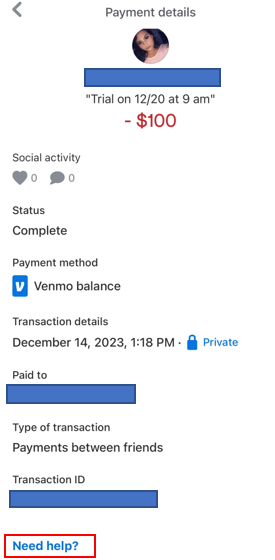

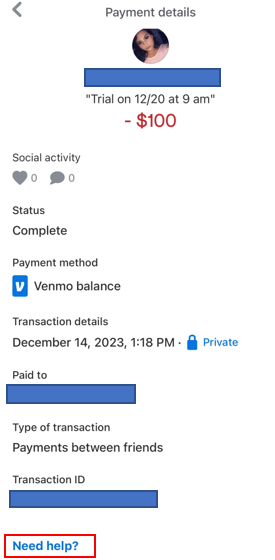

Here is my user experience:

Step 1:

I opened the transaction in question and clicked on “Need help?” at the bottom of the screen.

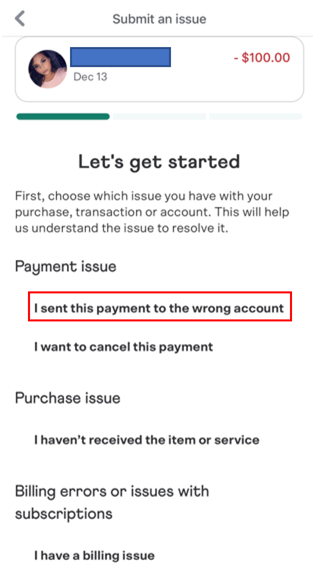

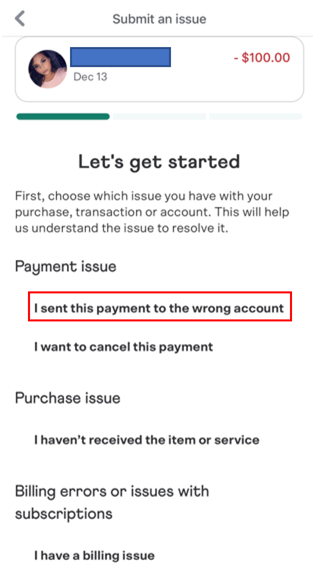

Step 2:

I selected “I sent this payment to the wrong account” and felt comforted knowing I must not be the first person to have made this mistake.

Step 3:

I was immediately directed to the Help Center, from here my only option was to select “Go to Help Center”

Step 4:

I was routed to an article in the Help Center, titled “I accidentally paid a stranger on Venmo.” It’s ironic how the first sentence in this article states “don’t worry,” but then it goes on to say “Payments on Venmo generally can’t be cancelled…”

It provided directions on what to do if you mistakenly paid someone who you know—the recourse is simple, just send them a Venmo request for the same amount so the funds can be transferred back to you.

My situation was a bit more complex, I had no idea who I just paid. I continued to scroll down the article.

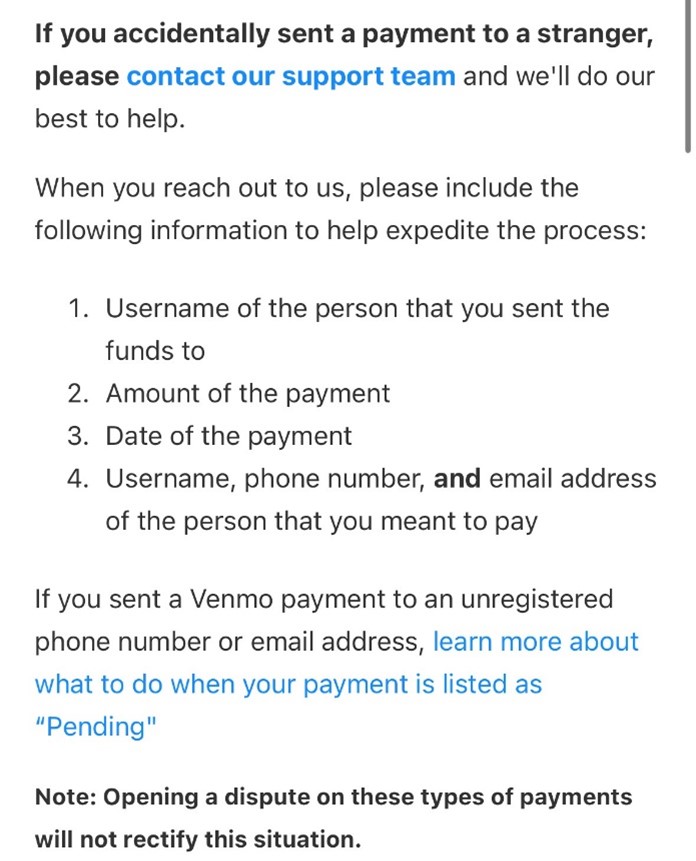

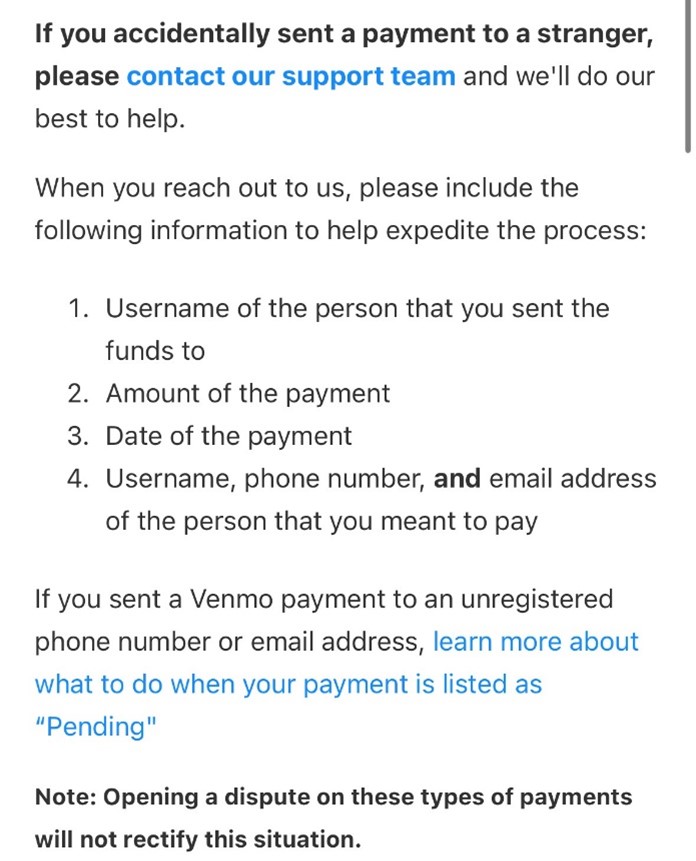

Step 5:

Towards the bottom of the article, I found a recourse section for sending a payment to a stranger. I selected the obvious “contact our support team,” but was not comforted with the boldfaced “Opening a dispute on these types of payments will not rectify this situation.” Yikes! The anxiety that flooded my mental state…

Step 6:

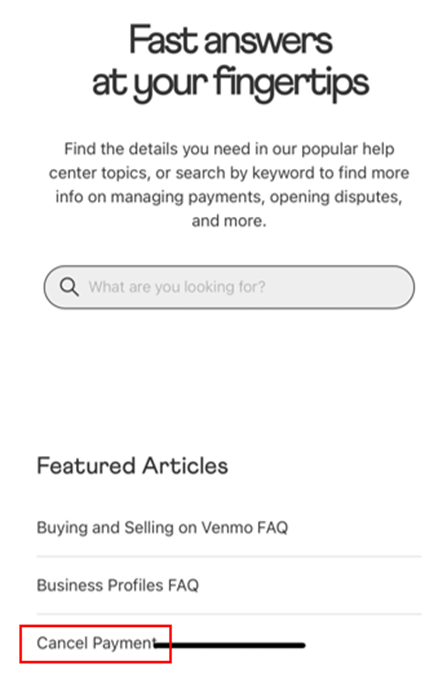

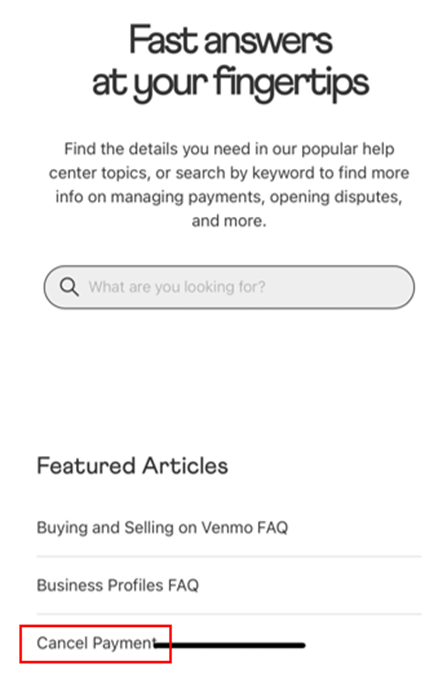

I was routed to a general “Contact Us” page and immediately clicked on “Cancel Payment” as that was the first fitting keyword I saw on the page.

Step 7:

The Cancel Payment page was bleak: “It is not possible to cancel a payment to an existing Venmo account.” Great, that got me NO WHERE! I continued to scroll down the page.

Step 8:

Towards the bottom, the “My payment went to someone I don’t know” section appeared. I noticed a link for “paid the wrong person,” but the color of the link was shaded a bit darker, indicating that would route me back to the same page I already visited. It felt like an endless loop. I clicked on the “contact us” button next to that link.

Step 9:

Back to the general “Contact Us” page. I officially hate it here!

I learned my lesson on clicking the “Cancel Payment” button towards the top of the page. This time I chose to scroll the entire page before clicking on any links.

Step 10:

At the bottom of the Contact Us page, I found a form to fill out. I included all information and screenshots showing payment instructions from my makeup artist alongside proof showing how the username I sent money to was one-letter off. I submitted the form but was still worried that money would not be returned to me. What if the stranger already transferred the funds to her bank account? Remember how Venmo’s previous page told me that opening a dispute would not rectify the situation? I felt uneasy.

When I landed on the form submission page, I was alerted it could take up to 24 hours to receive a response. The time was 1:28 pm and I received an email confirmation of my message.

I received a response from Venmo at 1:47 pm stating the following:

I was relieved that Venmo got back to me within about 20 minutes and confirmed I would be getting my money back.

However, this experience has left me questioning Venmo:

- Why did I have to jump through 10 confusing steps to get my money back? That was not a seamless user experience.

- If I didn’t catch the error immediately, would I have received a different outcome? If the stranger had transferred the money, what would Venmo have done?

Venmo should provide greater clarity around transactions made in error and easier steps to take when an error is detected. Users do not want to be thrown into an endless loop of unhelpful “helpful articles,” we want quick solutions and to know the payment platform we are transacting on has our back.

Overview by Sophia Gonzalez, Research Analyst, Debit Advisory Service at Javelin Strategy & Research.