My journey with American Express began in 1998, a year that pales in comparison to my father-in-law’s card, a relic from 1959, the era of “Mad Men.” As a budding banker at Citi and Chase, I often discussed his long-standing relationship with Amex. He was an early adopter of credit cards, launching his CPA career with Peat Marwick Mitchell. To him, the American Express Green Card was the way to go. No revolving debt and stay disciplined because you cannot run up a balance. As a bank card pioneer, that made sense to understand. But where do rewards come in?

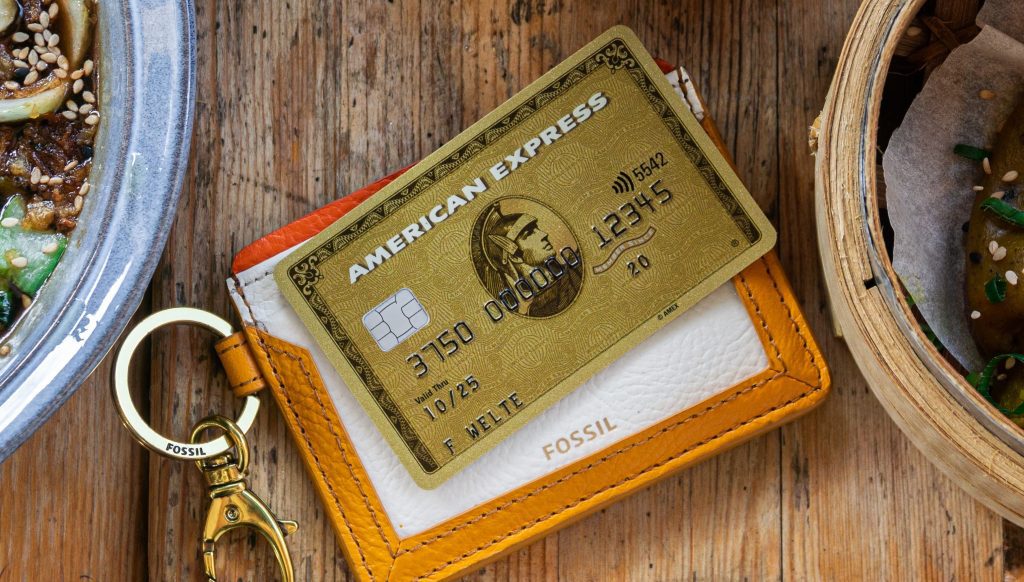

Over the years, we both commented on how quickly Amex services inbound calls, the nuances of call center technology developments, and how Amex was always on top of things—a direct contrast to a CFPB complaint cited in a recent report. According to the CFPB on a cardholder complaint: “Another said they reached out to the issuer over 50 times,” referencing this complaint. According to CFPB records, the issue was “closed with non-monetary relief.” But as an Amex cardholder, who rarely leaves home without my American Express Blue Preferred card in hand, I say “check the math on the claim of ‘50 calls’ and then look for other exaggerations. My Amex Delta Platinum is not too shabby, either.

For those with a keen interest in payments, CFPB reports are a treasure trove of information. Their latest report on Rewards is a must-read, offering a wealth of intriguing numbers and additional insights in the footnotes. The report is worth a read, for sure.

Who Pays for Rewards?

If the claim is that non-reward customers pay for my rewards as a consumer, I have to ask: “What will happen to my pricing after credit card delinquency fees drop from $32 to $8? I wouldn’t say I like the thought of revolving, and the potential penalty keeps me in check, but call center salaries are on the rise, and someone will need to cover the revenue cost.

But in an industry with 595 million active credit cards and more than half tied to credit card rewards, the 1,200 reward complaints cited for 2023 indicate there are many happy cardholders out there. And if you want to go for the big hit, check out credit bureau reporting complaints, which the CFPB observed accounted for 75% of all consumer complaints in 2022.