We all have plenty to be thankful for, but for credit card managers this is one for the books.

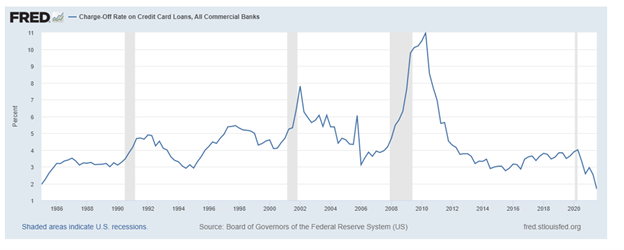

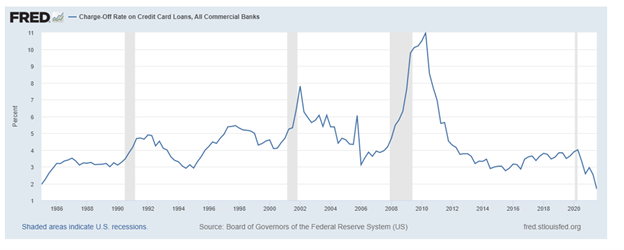

This morning, the Federal Reserve announced the most recent charge-off rates for U.S. credit cards. The metric is a mere 1.67%. It is the lowest charge-off rate on record since 1985. This means a few things for 2021 MBOs and 2022 bonuses:

- If you are an executive manager that owns the revenue line, loss reserves are probably also at their lowest point. Interest and non-interest revenue might have risk, but didn’t those CECL reserves pay off?

- If you are a line manager accountable for collection losses and delinquency flows, write down 1.67% and make sure everyone knows it. A rate like this is historic.

- If you are a marketing manager, now is the time to push out your direct mail and hone offers.

- If you are a fintech BNPL lender, this is the aspirational model for credit underwriting. Yes, credit bureau reporting is a necessity.

Make hay as the sun shines, as they say. Unfortunately, the trend will not last through 2022.

As we said in the 2022 Credit Outlook, the economy faces some gloomy times ahead as CECL reserves dry up, inflation boils, and interest rates ascend.

You can find Mercator’s outlooks for every practice here or listen to our recent podcast.