The First Credit Card

In 1958, Bank of America and Visa launched the BankAmericard in Fresno, California, which became the first successful credit card and revolutionized unsecured lending. More than six decades later and with billions of cards issued, the credit card of today still resembles its ancestor, with a form and features designed for payment transactions in the brick-and-mortar world rather than digitally. [1]

While this is a testament to the durability and proposition of the credit card, the world has changed many times over since its introduction. Today’s credit cards must prioritize “digital first” experiences, discussed further in this article.

The Macro Trends Impacting Credit Cards

Not counting the evolutions in technology and changing consumer preferences in the last few decades, the last few years have pushed both cardholders and issuers to digitize at an unprecedented pace. First, the pandemic and its associated lockdowns severely restricted in-person payments and increased digital, or card-not-present (CNP), payments. In the initial days of the pandemic, CNP payments, which are primarily used for e-commerce, saw more than a 20% growth year over year.[2]

Next, when in-person transactions resumed, cardholders increasingly preferred contactless transactions when using cards and mobile wallets. Mastercard reported a 40% increase in contactless transactions during 2020 (and these trends, while tempered post-pandemic, are in one direction). [3] This has also led to increasing demand for tokenized cards. Visa recently reported issuing more than four billion tokens, which is more than all its physical cards in circulation![4]

At the same time, cardholders now demand the same level of personalized service from issuers as they expect from consumer-facing tech companies such as Uber, Amazon, Google, and Facebook. A recent EY survey reported that 81% of Gen Z customers think that a more personalized service can help deepen their relationship with their issuer.[5]

Finally, the increase in digitization has also led to an uptick in credit card fraud, and cardholders are looking for better ways to protect their cards. Each of these trends taken individually and compounded together will only deepen their impact on issuers during the next few years.

In this four-article series, we will discuss in detail the impact of the growing shift toward digitization on US credit card issuers.

We’ll cover:

- What customers mean when they think of “digital first” card experiences

- Why card experiences must be embedded into customers’ digital lives vs. existing only as plastic

- How and why customers are demanding bespoke experiences from their issuers

- How issuers should embrace and respond with velocity to the myriad market changes

Let’s dive in to talk more about digital first card experiences.

Immediacy: Instant Issuance and Tokenization

Today’s customers expect instant delivery of pretty much everything — groceries, cab rides, and e-commerce shopping, for example — and this extends to getting a credit card as soon as they’re approved for one. 44% of surveyed consumers in the Deloitte Consumer Payments Survey 2021 strongly indicated that instant issuance would improve their payment experience. [6] It’s also essential to ensure the presence of digital first experience where consumers want to transact. In the same survey, 55% gave importance to the ability to push their cards to their favorite card wallet apps and e-commerce merchants. Therefore, issuers need to proactively ensure that they use the right technology to enable these features for their customers.

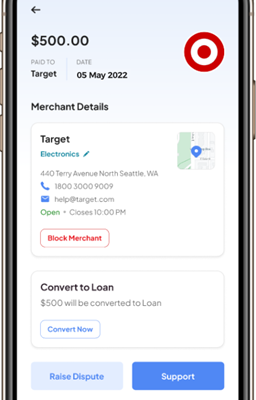

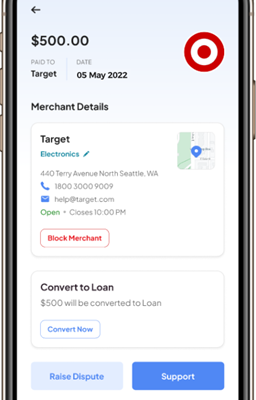

Power: Fine-Grained Credit Card Controls

It’s no surprise cardholders like being in control of their cards. While being able to turn on and off a card, block international transactions, and block ATM and point-of-sale (POS) use are table stakes today, issuers looking to be recognized as visionaries in the digital first experience must enable more fine-grained controls for their cardholders. Cardholders will soon expect to set individual transaction limits and aggregate limits, allow and block certain merchant categories and issuers, provide geo-location- and time-of-day-based controls, and more.

Trust: Security Features That Belong in 2022

With rising fraud, cardholders are also concerned about security. It’s surprising that today’s cards are protected by four-digit personal identification numbers (PINs), which are less complex than the security of most consumer email or Netflix accounts. It gets worse. When cardholders transact online, security complexity is reduced to only a three-digit card verification value (CVV) — that’s actually printed on the card! And cardholders agree resoundingly that this is bad, with 77% choosing security as one of the most important things they will look for when choosing how they’d want to pay in the future.[8]

Issuers must consider deploying technology that makes it safer for cardholders to transact online. First, issuers should look at using dynamic CVV and PINs to ensure customers are secure even if their CVV or PIN is compromised. Constantly changing CVVs and PINs ensure that even in the event of a data breach, bad actors cannot use those credentials. Next, issuers should deploy technology to makes it easier for customers to create one-time-use virtual cards that would minimize risks while transacting online. Lastly, issuers must enable tokenization for cardholders to ensure that their cards stored at merchants are secure.

Source: Zeta (2022

Transparency: Enriched Transaction Visibility

Cardholders are also increasingly valuing visibility into their transactions and transparency on what they spent on and what they were charged. From August 2019 to August 2022, up to 30% of disputes between U.S. credit cardholders and issuers were related to statements. Issuers can fundamentally eliminate these disputes with rich, descriptive statements. [9] Issuers benefit in multiple ways when they move away from archaic statements that use merchant business names in transactions and move to rich statements that provide more recognizable brand names. In addition to merchant visibility, this results in enhancing their transaction statements for transparency, with clear links between fees and the transactions resulting from the fees.

Conclusion

While the shift to digital first credit card experiences puts pressure on issuers’ traditional and legacy product lines, the future is being written now and issuers have excellent opportunities to meet the needs of their cardholders across the dimensions of control, immediacy, trust, and transparency. Next-gen processors such as Zeta offer issuers a compelling technology stack to rise to the needs of their cardholders.

In the next part in this series, we will look at how issuers can leverage the embedded banking revolution to increase their product distribution.

[1] https://en.wikipedia.org/wiki/Credit_card

[2] https://investor.aciworldwide.com/news-releases/news-release-details/global-ecommerce-retail-sales-209-percent-april-aci-worldwide

[3] https://www.cnbc.com/2020/04/29/mastercard-sees-40percent-jump-in-contactless-payments-due-to-coronavirus.html

[4] https://usa.visa.com/about-visa/newsroom/press-releases.releaseId.19116.html

[5] https://www.ey.com/en_gl/banking-capital-markets/how-can-banks-transform-for-a-new-generation-of-customers

[6] https://www2.deloitte.com/us/en/pages/financial-services/articles/elevating-the-digital-payment-experience.html

[7] Logos showcased in the graphic are the copyright of their respective brands. They have been used for illustrative purposes only.

[8] https://www2.deloitte.com/us/en/insights/industry/financial-services/consumer-payment-survey.html

[9] CFPB complaints database, accessed on September 1, 2022

[10] Logos showcased in the graphic are the copyright of their respective brands. They have been used for illustrative purposes only.